FUND ACCOUNTING

FUND ACCOUNTINGAltaReturn’s Fund Accounting Solution provides the operational efficiency and seamless control that allows accounting and finance teams to manage their daily activities with ease

KEY FEATURES

-Standard business process workflows

-Management of complex fund and investment structures

-Full multi-currency general ledge

-Partner transfer and subsequent close automation

-Maintenance of allocated accounts by investor

-Out of the box financial statements

-Native Microsoft Office integration

-Broad asset class support

-Cash & bank account management

-Check writing and vendor management

Business Process Workflows guide the user through the process of entering any type of transaction in a consistent and auditable fashion. Built-in drill through reporting provides instant access to the details you need to better understand your financial results.

Every aspect of your fund or investment structure can be captured, managed and monitored. Seamless integration with our Business Intelligence solution means everything from standard operational reports to full financials can be produced with minimal effort.

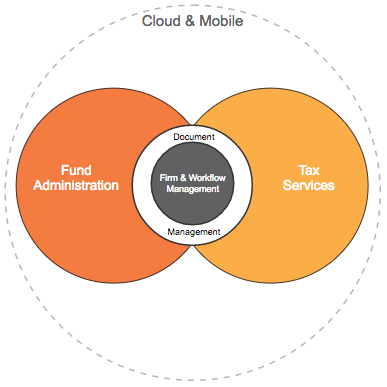

By itself, GoSystem Tax RS is a powerful tax compliance system. But when its data is shared with other software programs, its power increases. With timesaving links available in GoSystem Tax RS, you can instantly access Checkpoint content and PPC Deskbooks simply by clicking on the icon in the GoSystem Tax RS toolbar. The integration doesn’t stop there. Also included in GoSystem Tax RS is the ability to integrate data with the products in the CS Professional Suite and Enterprise Suite, as well as EMC Documentum®, SurePrep®, Copanion, BNA and Intacct.

INTEGRATION WITH OTHER PRODUCTS

SHARED DATA SAVES VALUABLE TIME

By itself, GoSystem Tax RS is a powerful tax compliance system. But when its data is shared with other software programs, its power increases.

With timesaving links available in GoSystem Tax RS, you can instantly access Checkpoint content and PPC Deskbooks simply by clicking on the icon in the GoSystem Tax RS toolbar.

The integration doesn’t stop there. Also included in GoSystem Tax RS is the ability to integrate data with the products in the CS Professional Suite and Enterprise Suite, as well as EMC Documentum®, SurePrep®, Copanion, BNA and Intacct.

CS PROFESSIONAL SUITE ACCOUNTING

DOCUMENT MANAGEMENT

PRACTICE MANAGEMENT

TAX

STREAMLINED PROCESSING

STREAMLINE WORKFLOW WITH INTEGRATION

For fast, two-way integration of balances and adjustments to GoSystem Tax RS, you can use the trial balance features available in Engagement CS. This powerful data sharing feature allows you to update data in Engagement CS and GoSystem Tax RS simultaneously. You can quickly add, delete or change journal entries; assign new tax codes; and add new accounts that can be added into GoSystem Tax RS within seconds. Other important workflow features in GoSystem Tax RS include the ability to:

• Integrate with QuickBooks®.

• Import asset information from Fixed Assets CS, our advanced fixed asset management software.

• Select tax default options from a comprehensive list, which completes much of your work before the data entry even begins.

• Use Partner Bridge to create Data Interchange Format (DIF) files automatically when you import and export partner information and special allocations with Microsoft® Excel®, including partner name and address, entity type, profit/loss ratios, capital account data and answers to K-1 questions.

• Transfer ending tax or adjusted balances between Engagement CS and the client’s database, and transfer general ledger balances from Trial Balance CS or Engagement CS.

• Take advantage of fast, integrated OCR processing when you own software from one of our preferred partners like SurePrep or Copanion.

EXPANSIVE IMPORT AND EXPORT CAPABILITIES

GoSystem Tax RS features a variety of ways to transfer information in and out of tax returns, greatly minimizing the return preparation process from beginning to end. Take advantage of a range of options from per-client imports on specific business activities to completely automated utilities that pull information into and from returns without requiring staff intervention. You’ll find these capabilities invaluable when preparing returns for clients that have large volumes of information—data that your staff would otherwise have to rekey.

IMPROVE WORKFLOW WITH GOTRACKER

Available as an add-on module, GoTracker allows administrators to log time, monitor due dates and set customizable milestones and tasks—improving overall workflow.